How much can i borrow on my income

Better than a payday loan. Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend you based on your income and expenditure.

Business Loans W Personal Guarantee Creative Business Plan Small Business Finance Business Funding

APRs start at 499.

. This is a difficult question to answer without knowing more about your financial situation. So for example if a persons total monthly debt payment is. For instance if your annual income is 50000 that means a lender may grant you around 150000 to 225000 for a mortgage.

How big of a loan you can get depends on which lender you go with and your personal finances. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. A general rule is that these items should not exceed 28 of the borrowers gross income.

Find out how much you could borrow Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. For this reason our calculator uses your. Looking For A Mortgage.

Ad Were Americas 1 Online Lender. Compare Mortgage Options Get Quotes. The first step in buying a house is determining your budget.

This mortgage calculator will show how much you can afford. Compare your new monthly payment to your old monthly payment. Personal Loans 2022 Low Interest Top Lenders Comparison Free Online Offers.

Ad Low Interest Loans. Get Your Estimate Today. Ad Get The Service You Deserve With The Mortgage Lender You Trust.

With a 401k loan you borrow money from your retirement savings account. Use our quick calculator to. Your annual income before tax Salary 000.

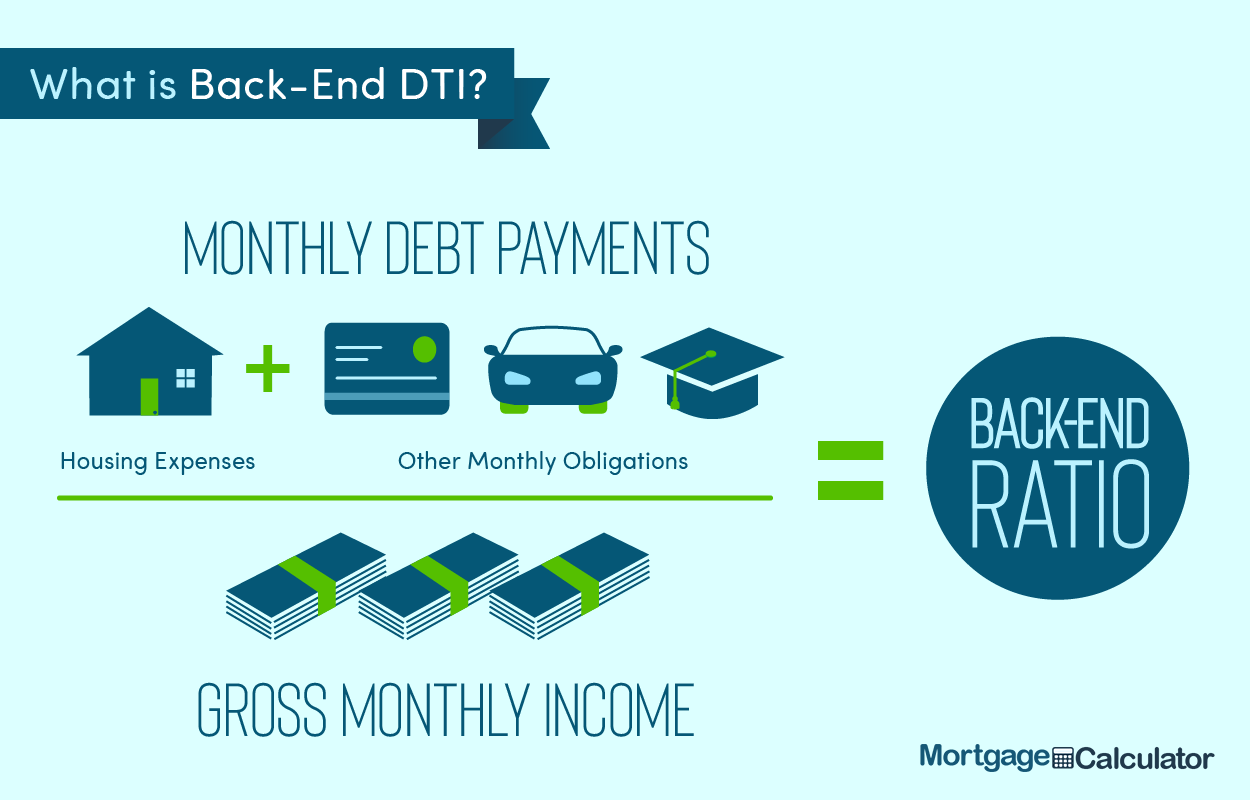

Fixed rates for the life of the loan plus minimal fees flexible payments. If your gross monthly income is 3000 your debt-to-income ratio is 36 when you divide 1100 by 3000. Get Started Now With Quicken Loans.

However some lenders allow the borrower to exceed 30 and some even allow 40. Fill in the entry fields and click on the View Report button to see a. That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term.

Borrow Cash Fast Online. Financial experts advise borrowers to keep their debt-to-income ratio. The maximum debt to income ratio borrowers can have is 50 on conventional loans which mean that monthly budget with the proposed new housing payment cannot.

How much can I borrow. This mortgage calculator will. Calculate what you can afford and more The first step in buying a house is.

Ad Borrow 500 to 50000 from a Top Rated Lender. As part of an. According to Brown you should spend between 28 to 36 of your take-home income on your housing payment.

Its designed to take everything into consideration your income dependents expenses and. Some lenders only offer personal loans up to 10000 while others such as. You may qualify for a loan amount ranging from 261881 conservative to 328942 aggressive Show details Conservative Aggressive 0 100K 200K 300K 400K Loan Amount.

How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. We base the income you need on a 450k. Get Started Now With Quicken Loans.

If you make 70000 a year your monthly take-home pay. Ad Its Fast and Easy to Apply and Youll Receive a Decision in Minutes. Ad Get The Service You Deserve With The Mortgage Lender You Trust.

28 or less of gross income. A 900000 home with a 5 interest rate for 30 years and 45000 5 down requires an annual income of 218403. How much you can borrow is based on your debt-to-income ratio.

How much can I borrow for a mortgage based on my income. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. See the results for How much can i borrow for a home loan in Blount.

20 or less of monthly take-home pay. Ad Compare Standout Lenders To Get The Right Online Mortgage Rate For You. Get Your Estimate Today.

When it comes to calculating affordability your income debts and down payment are primary factors. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. How much house you can afford is also dependent on.

This estimate is for an individual without other expenses and your. Factors that impact affordability. For instance if your annual income is 50000 that means a lender may grant you around 150000 to 225000.

Compare Mortgage Options Get Quotes. How much can I borrow. You can use the above calculator to estimate how much.

But ultimately its down to the individual lender to decide. Loans for any Credit.

Options To Generate More Income In Retirement

Disposable Income Vs Discretionary Income What S The Difference Tax Deductions Borrow Money Income

Financial Rules To Do Money Management Advice Investing Money Finance Investing

12 Common Ways To Borrow Money With Pros And Cons Plain Finances Borrow Money The Borrowers Budgeting Money

Guarantor Home Loan Calculator Mortgages With A Guarantee In 2022 Loan Calculator Home Loans Loan

I Lived On 51 Of My Income Saved 17 000 Money Saving Strategies Money Management Advice Budgeting Money

Pin By Ruby Powell Lenior On Business Emergency Loans Career Success The Borrowers

Look At The Fruit Does The Advice You Take Measure Up To The Fruit They Produce Financial Quotes Take Money Personal Finance Advice

Believe It Or Not There Is Such A Thing As Good Debt In Real Estate If You Use A Loan To Purchase A P Financial Education Financial Wealth Financial Freedom

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

M1 The Finance Super App

Online Cash Advances Software Apps Linux

3 Likes 0 Comments Melissa Jackson Crawfordfinancial On Instagram With The World Being So Uncertain And Jo Credit Repair Credit Repair Business Credits

12 Questions To Ask Yourself Before Buying Something Buy Clothes Ways To Save Money Life On A Budget

Pin By Beverly Blades On Budget In 2022 Investment Accounts Investing Finance

Unchained Freeing Myself From Student Loans Student Loans Student College Debt

Pin On Dividend Income Glory Investing Show